Medicare Part D Guide: What You Need to Know

Introduced in 2006, Medicare Part D has since become quite tricky, with hundreds of plans to choose from. But if that sounds daunting, don’t worry—this guide will help you navigate the ins and outs of Part D and determine the best plan for you.

What is Medicare Part D?

Medicare Part D is the part of Medicare that covers only prescription drugs. While Medicare Part A covers drugs administered in a hospital and Part B covers drugs administered in a doctor’s office, Medicare Part D covers the drugs you purchase and take on your own.

Offered by private insurance companies and regulated by the federal government, Medicare Part D offers many choices. Once you select a Part D plan, it takes effect in addition to your Part A and/or Part B coverage. But no matter what plan you choose, it's generally a good idea to have drug coverage—even if you don’t anticipate needing it yet.

Is Medicare Part D mandatory?

No, Medicare Part D is entirely optional. However, there are good reasons why 72% of all Medicare beneficiaries are enrolled in a Part D plan—and why you may want to consider one as well.1

- If you take medications but don’t have coverage elsewhere, Part D is a clear solution.

- If your existing coverage (such as through your employer) is not as good as Part D, then you may want to enroll in Part D to avoid paying penalties later. It’s important to note that these penalties increase each month that you don’t have Part D coverage.

- Even if you don’t take medications now, enrolling in a Part D plan now can be beneficial. Just like it doesn’t help to buy auto insurance after a crash, it doesn’t help to wait until you are diagnosed with a serious illness to buy Part D insurance. Chances are, you’ll need it down the road.

If you don’t enroll in Part D now but decide to after the appropriate enrollment period, you will then pay those late penalties—unless you have creditable coverage.

Creditable coverage means your current drug coverage is at least as good as Part D. To see if your current coverage is creditable, contact your plan’s administrator or HR representative.

How much does Medicare Part D cost?

On average, the premium (monthly payment) for a stand-alone Part D plan in 2020 is $30 nationally.2

But prices can vary by plan and your location. Your income also affects premiums and drug costs.

It could cost you more . . .

On your tax return, if your modified adjusted gross income (MAGI) in 2018 was more than $87,000, you must also pay an additional tax to Medicare on top of the Part D premium in 2020. The cutoff is higher for beneficiaries who file jointly, at $174,000. This surcharge increases as your MAGI increases.

There are also late penalties if you didn’t sign up for Medicare Part D at the right time which can increase your costs.

It could cost you less . . .

If you are under a specified resource or income level, you can qualify for Extra Help. Extra Help is a federal program that subsidizes Medicare Part D costs. It can pay for some or even most of your Part D expenses, depending on your financial situation.

Beyond Extra Help, your state may have programs to help you pay your Part D costs. Whatever your situation, if you are struggling to pay for drug coverage, it’s worth checking for possible help available to you.

See a more extensive breakdown of Medicare Part D costs in this article.

What does Medicare Part D cover?

Medicare Part D covers drugs you can administer yourself (and, surprisingly, it includes the shingles vaccine). This table shows when your prescription would be covered by Part A, Part B, or Part D:

Phases of Part D coverage

The way the coverage works under Part D is probably different than what you’re used to, so we’ve broken it down into more understandable pieces.

Medicare Part D has a few things in common with typical health insurance—for instance, monthly premiums, coverage for drugs included in a plan, and a system of copays or coinsurance. Beyond these few components, however, Medicare Part D works a bit differently.

For example, one way Part D is different from a typical health insurance plan is that within a year, you could possibly pay four different prices for the same drug. Your costs all depend on which “phase” of coverage you fall into.

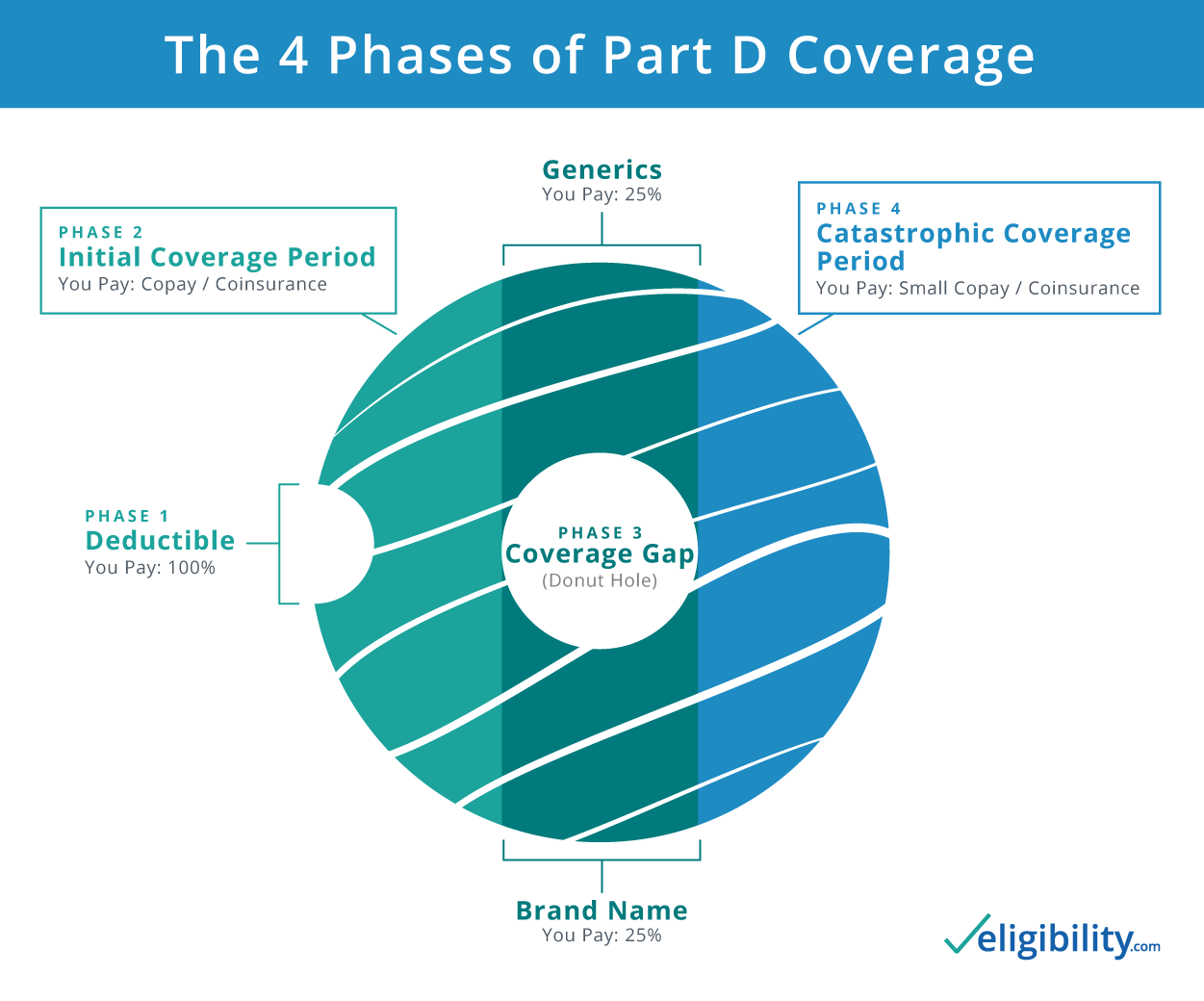

There are four phases of coverage:

Phase 1: Deductible period

If your plan has a deductible, you pay the full cost of your drugs until that deductible is met. Some Part D plans don’t have a deductible and begin with phase 2.

Phase 2: Initial coverage period

In this phase, you pay the copayment or coinsurance for your medications. This phase lasts until your drug costs reach a certain limit (in 2020, this limit is $4,020).3 Once you meet this threshold, you enter the coverage gap, but you may have heard of it by its more popular name, "the medicare donut hole."

Phase 3: Coverage gap, A.K.A., the “donut hole”

Previously, there was zero coverage provided by your insurance in this phase, but since the Affordable Care Act in 2010, the donut hole has been steadily shrinking.

In 2020, you pay up to only 25% for brand name and generic drugs in your plan. See more details on the donut hole, cost breakdown, and how to get out of it.

Once your out of pocket costs for the year reach $6,350 (in 2020), you enter phase 4.4

Phase 4: Catastrophic coverage

When your out-of-pocket spending reaches $6,350, you exit the coverage gap and enter catastrophic coverage. In this phase, your plan kicks back in full force and you pay only a small copayment on your covered drugs for the rest of the year.

Once the calendar year ends, you begin again at phase 1 and start the process all over.

Which drugs are covered by Medicare Part D?

Every Medicare Part D plan has a formulary, which is a fancy way to say a list of drugs covered by the plan. Every formulary is different, but must include at least two drugs in the following six categories:

- Anticancer drugs

- Immunosuppressants

- Antidepressants

- HIV/AIDS drugs

- Anticonvulsants

- Antipsychotics

But beyond this, plans can consist of anything a company wants to include. When looking for a Part D plan for yourself, you’ll likely want to choose the plan that covers as many of the medications you take as possible.

Are there limits to coverage?

In addition to drugs not be covered by your plan, there may also be other limits to your coverage. These roadblocks, known as utilization rules, are obstacles that you must overcome before you can get the medication you were prescribed. Other limits come in the form of a tier system.

Utilization rules

- Prior authorization: This rule means your doctor must advocate for why this medication is necessary for you (like in cases of potent or easily abused drugs).

- Quantity limit: If your doctor prescribes you a quantity that is over what they consider normal for that type of drug, they may place this restriction. Your doctor will have to explain why you need a higher quantity before your plan allows it.

- Step therapy: If there is a lower-cost drug that is similar to what your doctor prescribed, your plan may place this restriction. To overcome this, your doctor has to explain that you already tried the lower-cost drug and it doesn’t work as well as the one they prescribed.

Tier system for drug prices

Besides utilization rules, your drug plan may have a tier system of drugs. Depending on which tier your drugs are placed in, from Tier 1 (cheapest) to up to Tier 5 (most expensive), your costs may vary.

Each plan differs on which drugs it puts in which tier, based on what they can negotiate with manufacturers. When looking for a plan, try to get the one with as many of your medications in Tier 1 as possible.

When can I enroll in a Medicare Part D plan?

If you don’t have other drug coverage (specifically creditable drug coverage), it’s best to enroll when you sign up for Medicare Part A and/or Part B.

Typically, you want to do this during your Initial Enrollment Period (IEP), which runs for three months before your 65th birthday to three months after.

There is also an Annual Election Period (AEP), running from October 15—December 7 each year. If you didn't enroll during your IEP, you could enroll during the AEP.

How do I sign up for Medicare Part D?

It’s a bit of a process, but broken down into steps, it’s actually quite manageable. Fortunately, we have a handy guide to walk you through the whole process. Or, even easier, just give us a call and we can help find the best plan for your needs.

Conclusion

Hopefully, you now have a good grasp of Medicare Part D, how it works, and a few of the quirky components that differ from typical drug coverage. At this point, you’re ready to compare a few of the best Part D plans available.

Learn more about prescription drug coverage in the fourth video of our Medicare Prepared series.

Sources:

- Kaiser Family Foundation, “Medicare Part D in 2018”

- Centers for Medicare and Medicaid Services, "Trump Administration Drives Down Medicare Advantage and Part D Premiums for Seniors"

- Medicare, "Costs in the Coverage Gap"

- Medicare, "Catastrophic Coverage"

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.