What’s the Best Medicare Plan?

If anybody definitively tells you, "The best Medicare plan is _____,” you’ll know they don’t quite understand Medicare.

Medicare is not a one-size-fits-all program. A plan that’s best for one person might be a terrible plan for someone else. The most important thing to understand is that once you learn how Medicare works, you’ll be able to find the best Medicare plan for you.

What is Medicare?

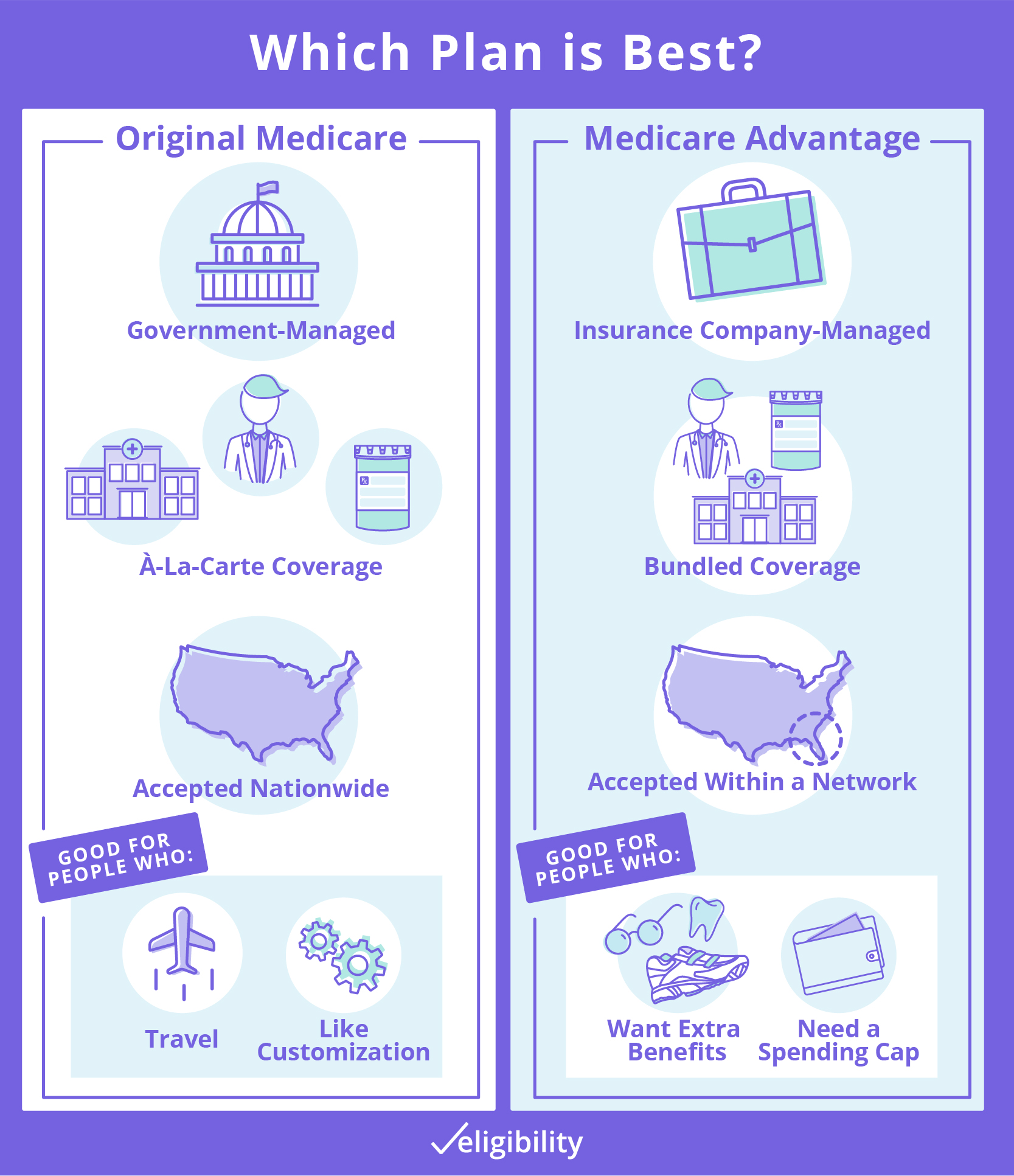

Medicare is a government health care program for anyone 65 or older and for people with qualifying disabilities. When starting out in Medicare, you’ll have a few options, but the main decision comes down to how you want to get your coverage. You can stick with the side of Medicare that’s operated by the government, or you can switch to the side that’s managed by private insurance companies. We’ll get into the basics of each below.

Want to learn more about Medicare? We created a video series to help kick-start your journey.

Original Medicare: Government-run health care

The government-operated side of Medicare is called Original Medicare, which consists of two parts: Part A and Part B. People can enroll in Medicare Part A or Part B, but most enroll in both since they cover most of your health care needs.

What is Medicare Part A?

Part A covers inpatient hospital and skilled nursing facility stays. Part A is often called “hospital insurance.”

What is Medicare Part B?

Part B provides coverage to see doctors or specialists, get procedures, and a lot of general medical necessities other than prescription drugs. Part B is often called “medical insurance.”

Pros of Original Medicare

Original Medicare is a good fit for people who travel frequently within the country. That’s because Original Medicare doesn’t limit beneficiaries to a network—it works with every doctor who accepts Medicare, nationwide.

Original Medicare could be a good option for people who like to custom-tailor their plans to their needs. Besides Part A and Part B, beneficiaries can add a standalone Part D plan to cover prescription medications. Beneficiaries can also add a Medigap (or Medicare Supplement) plan to help cover their Medicare costs.

Cons of Original Medicare

Original Medicare isn’t for everybody, and it may not be best for people with tight budgets. This is because, although Original Medicare is customizable, each component you add raises your monthly premiums. Overall, your up-front costs could be much higher in Original Medicare than they are in Medicare Advantage.

Original Medicare might not be a good fit for people who want a cap on health care spending, since Original Medicare lacks an out-of-pocket limit. Without this limit, your health-care spending is potentially limitless, meaning you could end up paying quite a lot for expensive procedures (chemo treatment, organ transplant, etc.) if you don’t purchase Medigap to supplement these costs.

Medicare Advantage: Medicare health plans from private insurers

Medicare Advantage, often called Medicare Part C, is the alternative to Original Medicare. It is a broad category of Medicare plans sold by private insurance companies. Medicare Advantage plans resemble employer-sponsored plans as they typically have networks and out-of-pocket limits.

These Medicare plans bundle your coverage into one plan, which will always include the same benefits as Part A and Part B, often offering more. Most Medicare Advantage plans include prescription drug coverage. Many also include vision, dental, and hearing benefits, as well as a fitness membership (like SilverSneakers or Silver&Fit).

Pros of Medicare Advantage

Medicare Advantage is a great fit for people who like extra benefits since it offers many benefits that aren’t available through Original Medicare—often for no extra cost (no additional premium). Plans have even begun offering benefits that are indirectly health-care related, such as transportation to a doctor, an over-the-counter medication allowance, assistance for grocery shopping, pest control, and more.

Medicare Advantage is also a good fit for people who want a limit on their spending. Medicare Advantage plans include out-of-pocket limits, meaning that once your health-care spending hits the limit, you don’t have to pay a dime for health care until next year—apart from any monthly premiums. The out-of-pocket limit isn’t available in Original Medicare unless you purchase one of two specific Medigap plans (Plan K and Plan L).

Cons of Medicare Advantage

Being limited to a network is one of the most significant drawbacks of Medicare Advantage. As such, it may not be the best for snowbirds or RVers.

Although some types of plans provide coverage out of network (such as a PPO or HMO-POS plan), they won’t cover out-of-network costs as well. Staying in a Medicare Advantage network may also mean you have to change primary care providers to one who is contracted with your plan.

Medicare Advantage might not be the best for people who don’t want to dig into plan details. At first blush, Medicare Advantage is significantly cheaper for more features. However, plans may compensate for lower up-front costs with more modest coverage for particular services or procedures. To find the best Medicare Advantage plan, it’s a good idea to look through a plan’s Evidence of Coverage (EOC) to see how the plan will cover services you anticipate needing.

Should I choose Original Medicare or Medicare Advantage?

If you need help deciding, read our in-depth Original Medicare vs. Medicare Advantage review pitting both programs head to head. See which one wins your vote.

If you already know you’re leaning toward Medicare Advantage, be sure to read our guide on how to pick the best Medicare Advantage plan.

If you know you want Original Medicare, consider enrolling in Part D to cover prescription medications. Here’s how to compare Part D plans to find the best one. Don’t forget Medigap insurance to help cover your costs. Here’s how to enroll in Medigap.

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.