Medicare Part D Costs

Part D prescription drug coverage helps millions of Original Medicare beneficiaries pay for their medication costs. Those benefits, however, come at a price.

Nationwide, the average monthly Part D premium in 2020 is $30.1 If you find a plan that’s cheaper, it might be tempting to snag it and call it a day.

Unfortunately, premiums aren’t the only cost Part D beneficiaries encounter. You may also come up against deductibles, copayments or coinsurance, and other out-of-pocket costs. These costs make for terrible surprises, so don’t get caught off guard.

Instead, read on to find out the following:

- The latest Part D premiums, deductibles, copayments, and coinsurance

- How your costs change in the four coverage phases

- How to get help with your Part D costs

- How to avoid late enrollment penalties

Based on Medicare.gov. Data effective 12/12/19.

Costs vary widely from plan to plan. If you're ready for coverage but don't want to spend a lot of time shopping around, get a Medicare health plan quote tailored to your needs.

What you pay for Medicare Part D premiums

Most Part D plans include a premium cost (a fee you pay each month for coverage). For Part D, your premium has two parts:

- The Medicare portion based on your income

- The insurer’s portion, which varies from plan to plan

The Medicare portion of your premium depends on your Modified Adjusted Gross Income (MAGI) from your most recent tax return.

Income-based portion of the Part D premium 2020

Based on Medicare.gov. Data effective 12/12/19. Actual costs may vary.

Your Part D insurance company decides how much it will charge you in addition to the values in the table above. How much you’re charged depends on which plan you choose.

Although the CMS decides what the Medicare portion of your premium will be, you'll make a single payment each month directly to your insurer. This payment includes both the Medicare portion and the insurer portion of your premium.

What you pay for Medicare Part D deductibles

Your Part D plan may include a yearly deductible. The deductible is the amount you must pay out of pocket each year before the Part D plan kicks in and starts to help cover the costs of prescriptions.

Deductibles vary between plans, but CMS sets a maximum deductible each year ($435 in 2020).7 That means you might have a lower deductible or even no deductible, but you won’t have one higher than the maximum CMS sets.

Once you meet your Part D deductible, you begin the Initial Coverage Phase of your plan, during which you'll pay coinsurance or copayment for prescriptions.

Part D copayments and coinsurance

Copayments and coinsurance are similar: they represent the portion of costs you pay for your Medicare prescription drugs after you meet your deductible. The difference is in the way insurers calculate those portions.

Copayment: a set dollar amount—such as $10—that you pay for covered prescription drugs.

Coinsurance: a percentage of the cost—like 20%—that you pay for prescription drugs.

Generally, your copayment or coinsurance will change depending on what drugs you take. Companies often categorize medications into five categories, or tiers. The higher the tier, the higher your portion of the costs will be.

Medicare Part D drug tiers

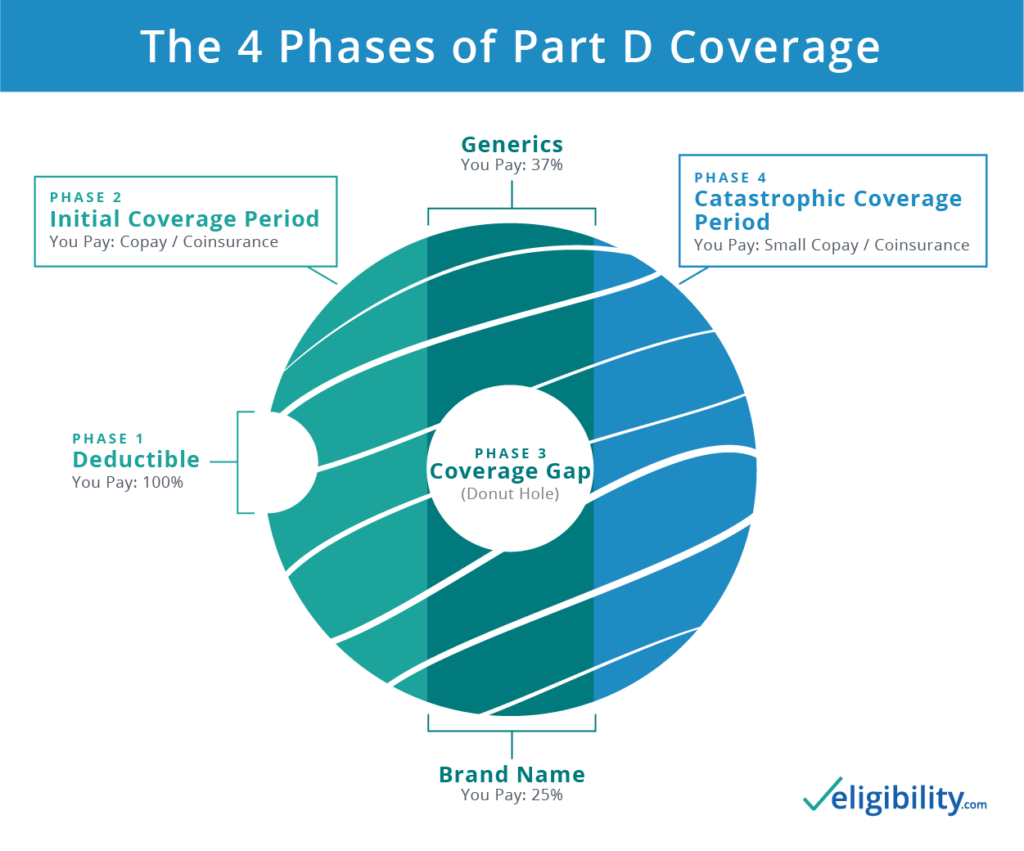

Your Part D coverage changes as you spend

Throughout the year, the portion of drug costs you pay will change. That’s because you’ll enter different phases of coverage.

The first phase begins as soon as your coverage starts with a pre-deductible phase. When you meet your deductible, the Initial Coverage Phase begins, and so on. We'll explain it all in the next sections.

What’s the Part D Initial Coverage Limit?

Once the value of the prescriptions you buy reaches your plan’s Initial Coverage Limit (ICL), the Initial Coverage Phase ends.

What’s your ICL? Insurers have some freedom to set this limit, but they must follow CMS guidelines. That means your ICL won’t be higher than $4,020 in 2020 (up from $3,820 in 2019).8

After you meet the ICL, the next phase of Part D coverage begins: the coverage gap.

What’s the Part D coverage gap/donut hole?

The coverage gap, or “donut hole,” phase begins once you reach your Initial Coverage Limit.

What does that mean? These days, not much. Since 2011, the federal government has been working to close this coverage gap, so it may not affect you much.

In the past, the dreaded donut hole was a period when beneficiaries had to cover the majority of their prescription costs out of their own pockets. The Affordable Care Act created regulations to close the donut hole entirely in 2020.

How will the Part D Coverage Gap affect me?

As of 2020, the gap has fully closed for brand-name and generic drugs. For these medications, you’ll pay no more than 25% of the cost. With some Part D plans, you may pay even less. Of the remaining 75% (if it's a brand-name drug), the drug manufacturer pays 70% of the cost, and the federal government pays the remaining 5%. If it's generic, the government covers the remaining 75%.

What’s Catastrophic Coverage?

Once your out-of-pocket costs reach the Out-of-Pocket Threshold, you move from the coverage gap to Catastrophic Coverage, the last coverage phase. If you enter this phase (and many people don't), you'll pay just a small percentage (5%) of the costs for covered prescription drugs until the end of the calendar year.

How you can get Extra Help

Many Original Medicare beneficiaries feel the pain of prescription drug costs. If your Medicare prescription drug costs keep you up at night, consider asking for help, or Extra Help.

Extra Help, a federally funded low-income subsidy program, assists people with limited resources to pay their Part D plan prescription drug costs. To qualify in 2019, your assets must not exceed $14,390 if you’re single or $28,720 if you’re married and living with your spouse.9 The Social Security Administration hasn't published new values for 2020 yet.

To apply for Extra Help, you can fill out the Extra Help online application. You may also call Social Security at 1-800-772-1213 (TTY: 1-800-325-0778) or visit your local Social Security office.

What’s the late enrollment penalty?

CMS adds late enrollment penalties onto your monthly Part D premiums if you don't enroll when you're first eligible. The longer you wait to join, the higher the fee if you do eventually enroll. These fees will apply for as long as you have Part D coverage.

The reason for these fees? The Medicare drug benefit is a cost-sharing program. If people join a Part D plan only when their prescription costs grow too high, the program would go bankrupt. Late enrollment penalties encourage more people to sign up and help fund benefits for those who sign up late.

How to avoid late enrollment penalties

The simplest way to avoid late enrollment penalties is to enroll in a Part D plan (or Medicare Advantage prescription drug coverage) as soon as you become eligible for Medicare.

You first enroll in Part D during your Initial Enrollment Period (IEP), which occurs near your 65th birthday or your 25th month on disability, whichever applies to you. Don’t wait until the fall Annual Enrollment Period (AEP).

Already have coverage from another source, such as an employer or union? That’s great! You can put off enrolling in Part D without incurring any late enrollment penalties for as long as you have other coverage, under one condition: you can prove it’s creditable.

How to prove you have creditable coverage

In Medicare-speak, “creditable drug coverage” means coverage that’s as good or better than Part D.

When you apply for a Part D plan with an insurer, it might see proof of creditable coverage in your records. If not, the company sends you a form to fill out with your previous coverage information.

To make this process easy on yourself, keep records of your prescription drug coverage. Most insurance plans will tell you whether they provide creditable coverage each year. If you’re not sure, ask. It’s much easier than finding out later your coverage doesn’t qualify.

If your current prescription drug coverage ends soon, start the enrollment process for Part D as soon as you can. Penalties start accruing just 63 days after your creditable coverage ends.

If you qualify for Extra Help, the late enrollment penalty doesn’t apply.

Tips to minimize your Part D Prescription drug costs

The exact costs you pay for Medicare prescription drugs can vary depending on several factors. To reduce your Medicare Part D costs, we recommend the following:

- Check your plan’s formulary (drug list) to ensure it covers the medications you take.

- Stick to pharmacies within your plan’s network.

- Talk to your doctor about prescribing cheaper or generic drugs.

- Pay close attention to your plan’s Annual Notice of Change (ANOC) when insurers send them out each fall.

- Shop plans each year during the Open Enrollment period to ensure you still have the best plan for your situation.

Compare Part D plans

The costs for prescription drug coverage vary, so get quotes from several plans. That’s where we can help—our licensed sales agents can quote multiple insurers to help you find the right plan for your needs.

Sources

- Centers for Medicare and Medicaid, "Trump Administration Drives Down Medicare Advantage and Part D Premiums for Seniors"

- Centers for Medicare and Medicaid, "Trump Administration Drives Down Medicare Advantage and Part D Premiums for Seniors"

- Medicare, "Yearly Deductible for Drug Plans"

- Medicare, "Costs in the Coverage Gap"

- Medicare, "Catastrophic Coverage"

- Medicare, "Part D Late Enrollment Penalty"

- Medicare, "Yearly Deductible for Drug Plans"

- Medicare, "Costs in the Coverage Gap"

- Social Security Administration, "Understanding the Extra Help with Your Medicare Prescription Drug Plan"

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.