Medicare Enrollment Periods Cheat Sheet

Unlike the health insurance you may have had as an employee, Medicare has multiple enrollment periods—each designed for people in a specific situation. If you miss the right period, you could end up going without coverage and racking up Late Enrollment Penalties (LEPs).

Avoid Medicare enrollment pitfalls by understanding Medicare’s various enrollment periods and whether you might qualify for them.

Initial Enrollment Period (IEP): When you’re enrolling in Medicare for the first time

If you’re new to Medicare, you may not want to wait until the Medicare Open Enrollment Period to obtain health insurance. If you don't enroll until the fall after you’re first eligible, you could go without coverage—and rack up a Late Enrollment Penalty (LEP) to boot.

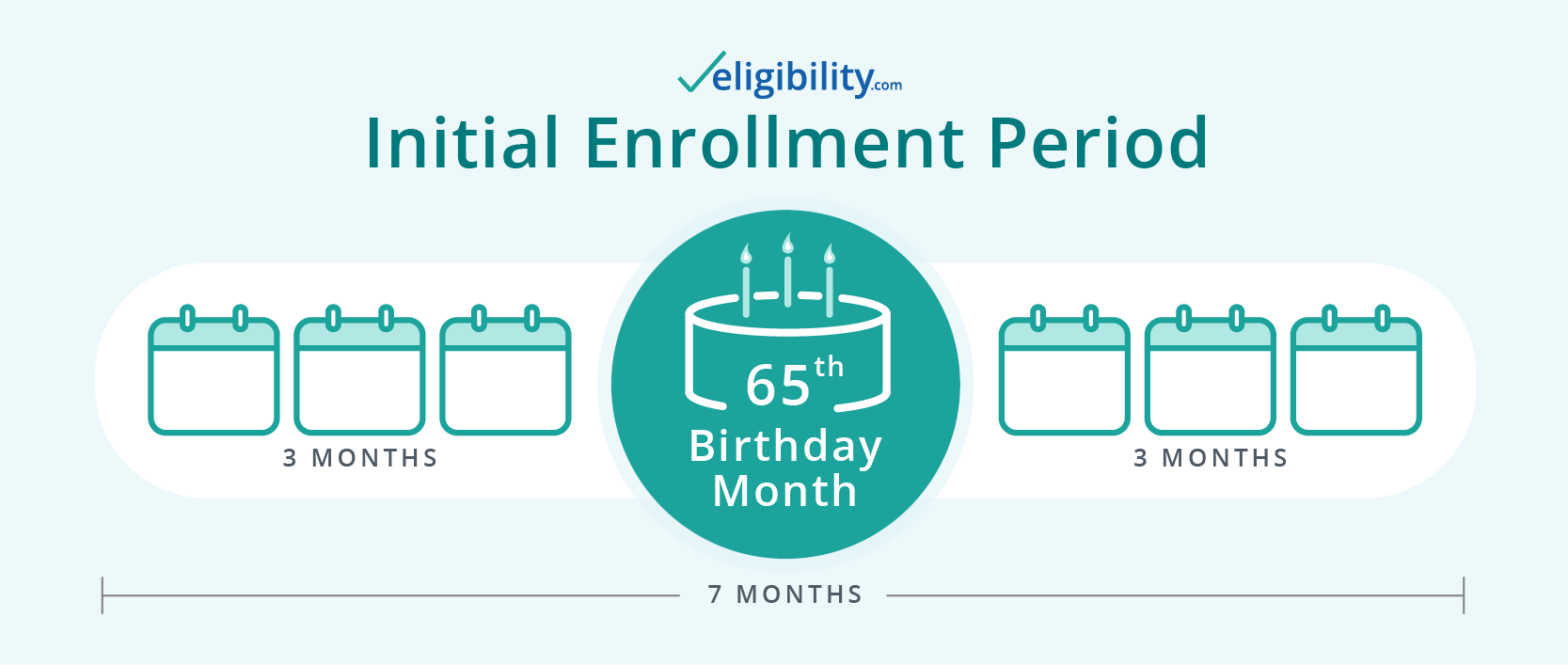

If you’re turning 65 soon or approaching your 25th month on disability, you’re entitled to your own enrollment period, called an Initial Enrollment Period (IEP). This seven-month period begins three months before you become eligible.

Annual Enrollment Period (AEP): For when you want to review, change, or add to your coverage

Every fall, the Centers for Medicare & Medicaid Services (CMS) and private Medicare insurers release finalized coverage changes for the following year. Many Medicare recipients use the fall Open Enrollment Period, also known as the Annual Election Period (AEP), to review their current coverage and shop around for plans that may better fit their needs.

Medicare Open Enrollment begins each year on October 15 and runs until December 7. At this time, you can apply for any part of Medicare, including Part A, Part B, Part D, Medicare Advantage, and Medicare Supplement plans

Medicare Advantage Open Enrollment Period (MAOEP): When you don’t like your Medicare Advantage plan

If you begin the year with a Medicare Advantage plan and then realize your needs have changed, the Medicare Advantage Open Enrollment Period (MAOEP) could save you from buyer’s remorse. Just don’t confuse this enrollment period with the fall Medicare Enrollment Period.

The annual Medicare Advantage Open Enrollment Period begins January 1 and continues through March 31. During this period, you can change to a different Medicare Advantage plan or switch to Original Medicare and add a Part D plan if desired.

Medicare Supplement Enrollment Period: When you want a Medigap plan

You can apply for Medicare Supplement insurance plans at any time, provided you have Original Medicare. But if you enroll during your Medicare Supplement Enrollment Period—shortly after you sign up for Medicare Parts A and B—you'll have guaranteed approval. Plus, if you enroll during this period, the insurer can't charge you more based on any health condition you may have.

If you wait until Open Enrollment to enroll in Medicare Supplement (Medigap)—and it is after your Medicare Supplement Enrollment Period is over—insurers could potentially deny you coverage or charge higher premiums. That’s because a Medigap plan works a bit differently than other Medicare plans.

Learn more about Medicare Supplement eligibility.

Special Enrollment Period (SEP): When you lose coverage unexpectedly

If your current Medicare or employer-provided coverage suddenly ends, you may not have to wait for Medicare Open Enrollment to obtain new coverage. Instead, that change may cause you to qualify for a Special Enrollment Period (SEP).

Many people use an SEP because they move out of their plan’s area, lose health insurance at work or as a result of retiring, or qualify for additional aid. But these aren’t the only situations that warrant an SEP. Some people qualify for a Special Enrollment Period and don’t even know it, so call the number below anytime you need a new plan. A Medicare expert will help you determine whether you're eligible.

What about enrolling in Medicaid?

Although Medicare and Medicaid sound like closely named twins, these completely separate programs are cousins at most.

Medicare is federally funded health care for people over 65 and those receiving Social Security disability.

Medicaid, on the other hand, is a government subsidy program designed to help people with limited resources cover their health care costs. If you think you may qualify for Medicaid, you can apply through your state’s Medicaid program.

If you qualify for Medicaid, don’t worry about losing your Medicare benefits. Plenty of people enroll in both government programs simultaneously. We call these recipients Medicare dual eligible.

Next steps: Enroll in a Medicare health plan

If you're ready to enroll in a Medicare plan, call a licensed sales agent. They can help you choose the right plan for you and determine whether you’re eligible for an enrollment period.

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.