How to Switch Part D Plans

Finding the right Medicare Part D prescription drug plan isn’t easy. So after you settle on one, switching plans—and going through the process all over again—might seem life a pain. But there are plenty of reasons to switch.

- Your doctor changed your medications or dosages

- Your insurance company changed up your plan

- Your current plan isn’t available in your area anymore

No matter what your reason for switching Part D plans, you can make the process faster and easier by knowing the ins and outs before you get started.

4 steps to switch Part D plans

Luckily, switching Part D plans is like choosing a Part D plan for the first time, so you’ve already had some practice. Like you did back then, you’ll need to take stock of your current medications to compare your drug costs with new plans.

1: Evaluate your current coverage and needs

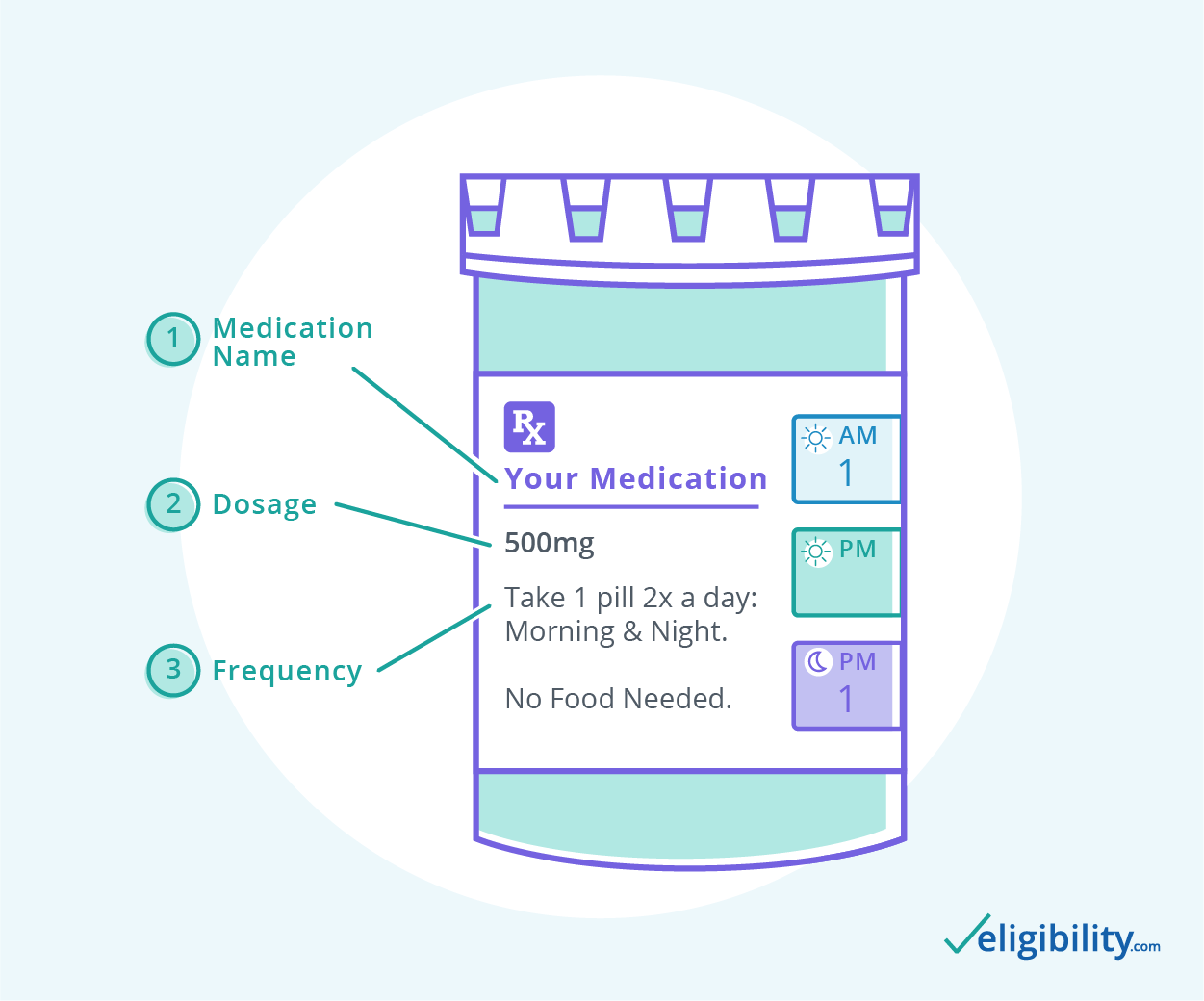

As with finding a plan for the first time, start by making a list of your current medications. Include the exact name, dosage, and frequency (how often you take it) as written on the bottle.

Next, gather any documents from your current plan, including your Evidence of Coverage and any receipts or bills that show your prescription costs. Add up what you’ve paid in premiums and in drug costs throughout the year to estimate your annual prescription drug costs.

Next, input your zip code, medications, and other information into the Medicare Plan Finder, just as you would if enrolling in Part D for the first time.

When your search results pop up, select up to three plans at a time to compare side by side. If you find your current plan, include it in your comparison to see if it still might be the best option for you.

As you browse plans, look beyond premiums to other Part D costs, such as the deductible, copayments, and estimated annual cost. Typically, a low-premium plan will have higher out-of-pocket costs than a higher-premium plan. A higher-premium plan could save you money over the course of the year if you regularly take several expensive prescriptions.

3: Pay attention to quality

The Centers for Medicare and Medicaid Services (CMS) measures Part D plan quality in stars,1 with five stars denoting the highest quality and one star the lowest quality. Medicare star ratings measure quality in several ways but primarily focus on how much a patient’s health improved while on the plan.

4: Enroll

Once you’ve chosen a plan (or narrowed it to a couple of choices) talk to a licensed Medicare insurance agent. They can help you finalize your choice and start the enrollment process.

When to change Medicare Part D plans

It’s a good idea to review your prescription drug coverage each year to ensure you’re still in the right plan for your needs, but there are limits to when you can change plans. Most people switch Part D plans during annual open enrollment (AEP), which occurs October 15 through December 7 each year.

If you’re switching from Medicare Advantage back to Original Medicare and want to add Part D coverage at the same time, you can do so during annual open enrollment or the Medicare Advantage Open Enrolment Period (MA-OEP) January 1 through March 31.

If you want to switch plans outside these two enrollment periods, you may do so if you qualify for a special enrollment period (SEP). There are many kinds of SEPs, and you could be eligible for one if you:

- Move out of your plan’s service area

- Lose coverage because your insurer withdraws coverage fromform your current area

- Can prove the plan failed to provide promised coverage (which you can do by filing an appeal)

- Leave Medicare Advantage to return to Original Medicare (for the first time)

- Move into a nursing home or other institution

- Join Programs of All-Inclusive Care for the Elderly (PACE)

- Lose or gain Extra Help (a government aid program that helps pay for Part D)

Finally, you can switch from any Part D plan to a 5-star plan at any time during the year (but just once during the fall open enrollment).

Learn more about Medicare enrollment periods.

What to expect when you change Part D plans

Once you enroll in your new Part D plan, you won’t need to contact the provider of your old plan. You’ll automatically be dropped from that plan when your new coverage begins. Keep an eye out for your new Part D Medicare card, formulary (list of covered drugs), and other plan documents. You may be able to print these online, but you’ll likely receive them in the mail as well.

If you switch Part D plans mid-year, some of your benefits may carry over from your old plan. What you’ve already paid toward your old deductible will still count toward your new one, even if your new plan’s deductible is different. Your progress through the Medicare Part D donut hole will transfer as well.

If your new coverage begins at the start of the new year, your deductible and progress through the donut hole will reset—just as it would if you hadn’t switched plans.

Should you change Part D plans?

It never hurts to shop around for better Part D coverage each year, but whether you should switch depends on your situation. Insurers change their plans up all the time, and your life won’t always stay the same either. Spending a few minutes looking at your options during fall open enrollment or if your insurance company makes changes to your plan could help keep your prescription costs down.

While you’re evaluating your drug coverage, you could check out your other coverage options, including Medicare Advantage and Medicare Supplement plans. Each has the power to save Medicare recipients money—but only if you enroll in the right plan for your needs. If you need help finding your best match, give us a call.

Sources

1. The Centers for Medicare and Medicaid Services, “Fact Sheet – 2020 Part C and D Star Ratings”

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.