The Medicare Donut Hole: What’s New in 2020

Medicare Part D is an optional prescription drug program that Medicare beneficiaries may add to their Original Medicare (Part A, Part B, or both) coverage. Sold by private insurance companies and regulated federally, there are hundreds of stand-alone Part D plans as of 2020—948 nationwide.1

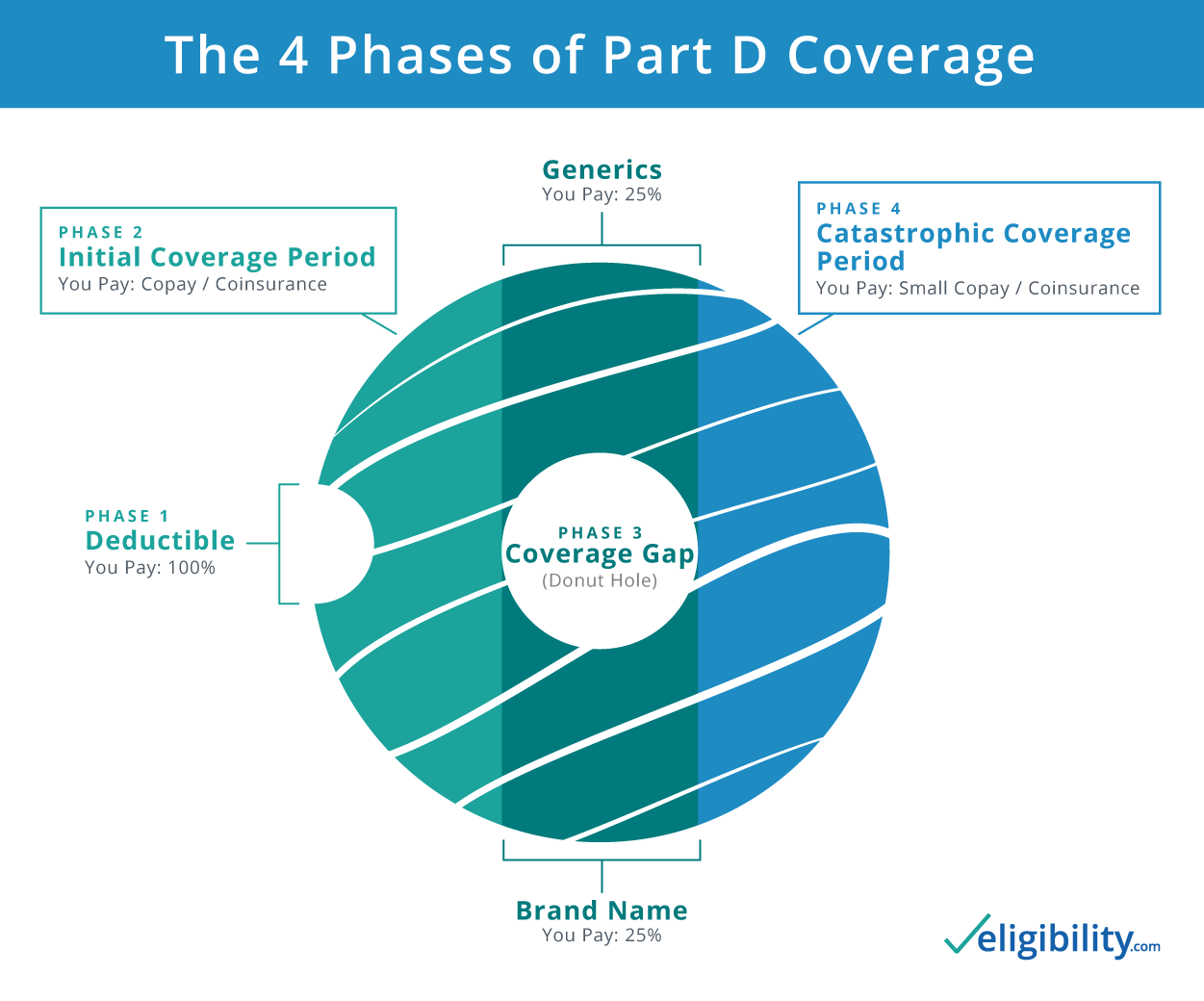

In exchange for premiums ranging anywhere from $12.18 to $191.40 (in 2020), enrollees receive Medicare prescription drug coverage.2 But the drug coverage likely looks a bit different than what you may have seen from employer-provided insurance plans—most notably in the four phases of coverage and the (infamous) donut hole.

Detailing the donut hole

The donut hole (also called the coverage gap) is the third out of four Part D phases of coverage, which starts once you and your plan have spent a specified amount on medications. It comes after the first phase (the deductible phase) and the second phase (the initial coverage phase)—you’ll read more on these phases later.

Originally, when beneficiaries reached the donut hole from 2006–2010, they had to pay 100% of their medication costs until they reached the fourth and final catastrophic coverage phase. This is why the donut hole is also called the coverage gap, because there was a complete gap in coverage until the next phase.

However, thanks to the Affordable Care Act of 2010, the donut hole began to shrink, starting in 2011. As of 2020, the donut hole is fully closed.

What does the donut hole look like in 2020?

In 2020, the donut hole is fully “closed,” meaning that the coverage provided by your drug plan should be as good as the minimum federal requirements during your initial coverage phase. Practically speaking, this means that your coinsurance in the donut hole will be at least this amount (but your plan may cover more):

- Brand-name drugs: You pay 25%, your plan pays 5%, manufacturer discounts remaining 70%

- Generic drugs: You pay 25%, your plan pays 75%

Medicare Part D: the four phases of coverage

Medicare Part D provides prescription drug coverage, but how it does so can be a bit complicated. An uninitiated beneficiary might be surprised to learn they may have to pay four different prices for the same medications in one year. These price variations are due to the four phases of coverage. Here’s how it works:

Phase 1: Deductible period

During this phase, you must pay the full price of your medications until you meet the deductible set by your plan. This deductible may be any amount, but no more than $435 in 2020 (up from $415 in 2019).3 Once you reach the deductible set by your plan, you move on to the next phase of coverage: the initial coverage period.

Note: Some plans have a $0 deductible, in which case enrollees would begin the year in Phase 2—the initial coverage period.

Phase 2: Initial coverage period

In the initial coverage period, your Part D plan begins paying a percentage of the cost for covered drugs. Generally, the plan pays ¾ and you’d pay ¼ of the cost, although some plans cover more. It’s not uncommon to see copays as low as $1 for generic medications during the initial coverage period.

Some people never go beyond the initial coverage phase in a year. But once both you and your plan combined spend $4,020 on medications in 2020 (up from $3,820 in 2019),4 you enter the coverage gap—commonly called the “donut hole.”

Phase 3: Coverage gap, a.k.a. the “donut hole”

By the time you reach the donut hole, your drug costs may not change nearly as much as they would have in previous years. Since the Affordable Care Act took effect in 2010, you pay (at most) 25% of the cost of both brand name drugs and generics.

When your out-of-pocket costs reach $6,350 in 2020 (up from $5,100 in 2019),5 catastrophic coverage kicks in and you enter the last phase.

Phase 4: Catastrophic coverage

In this phase, your coverage kicks back in—and then some. You pay 5% of the cost of your drugs or a small copayment.

Catastrophic coverage continues for the rest of the calendar year. But come January 1, the whole cycle begins again.

What sends me into the donut hole in 2020?

In 2020, once both you and your plan reach $4,020 total cost for your covered medications, you'll enter the donut hole. So, for example, if you pay $2 for a generic drug but your plan covers the remaining $8 of the cost, that would count as $10 toward your march into the donut hole. Also included in your total cost for drugs is your deductible (if you have one), but not your premiums for your Part D plan.

Once you’re in the donut hole, your coverage is set federally:

- Brand-name drugs: You pay 25%, your plan pays 5%, manufacturer discounts remaining 70%

- Generic drugs: You pay 25%, your plan pays 75%

Some plans may offer even greater coverage, but they all must cover at least the amounts above.

How do I get out of the donut hole in 2020?

Once you reach $6,350 of out-of-pocket costs (detailed below) for covered drugs in 2020, you'll exit the coverage gap. There are a few things that count toward your freedom from the donut hole:

- Your deductible (if your plan has one)

- What you’ve paid in coinsurance and copayments for covered medications

- The manufacturer’s discount on brand name drugs within the coverage gap

As a quick recap, before the coverage gap (donut hole), both what you and your plan pay for your medications send you toward the donut hole until you reach $4,020. Once in the donut hole, however, only the amount you've put toward covered medications (for the year), the manufacturer's discount on brand name drugs (while purchased in the donut hole), and your deductible count toward getting out.

Here’s what this looks like in a simple, real-world example:

Larry’s Part D plan has the standard $435 deductible. Larry meets his deductible, and his plan starts paying 75% of the cost of his brand-name drugs while he pays 25%. This continues until Larry crosses over into the donut hole, when the total cost toward Larry’s covered medications reaches $4,020.

Up to this point, Larry has paid $435 (the deductible) plus $1,005 (Larry’s 25% of $4,020) toward his medications.

$435 + $1,005 = $1,440 (Larry’s out-of-pocket expenses entering the donut hole)

Since Larry’s out-of-pocket expenses entering the donut hole are $1,440, he will have to incur an additional $4,910 (the $6,350 out-of-pocket limit minus Larry’s current $1,440) before he exits the donut hole. Luckily, if Larry continues buying brand-name medication, both his 25% coinsurance and the 70% discount on his drug in the donut hole will contribute to him getting out and into catastrophic coverage.

If you’re wondering where you’re at related to the donut hole, look at your Explanation of Benefits sent by your insurance company every month, which should include this information.

How do I avoid the donut hole altogether?

Not everyone will fall into the donut hole, and there are a few ways you can stay out of it:

- Buy generic medications. Generic drugs are typically much less expensive than their brand-name counterparts. Often, Part D plans negotiate even lower rates for certain generics (called “preferred generics”) and charge a copay as small as $1. This will slow your progression toward the donut hole.

- Find a Part D or Medicare Advantage (MA) plan that covers more of your medication costs. While every plan is federally regulated, they each have their own list of drugs they cover (called a formulary) and the tiers the medications fall into, i.e., the amount they charge for each drug. To learn how to find the best plan for you, see how to compare Part D plans.

- See if you qualify for Extra Help. Extra Help is an assistance program that subsidizes prescription drug costs. If a Medicare Beneficiary is under a specified resource level, they may qualify for Extra Help—in which case the donut hole doesn’t apply. To see if you are eligible for Extra Help, see the Social Security website.

- Use your plan’s Medication Therapy Management (MTM) program. Medicare requires every Part D prescription drug plan to have an MTM program. With MTM, a pharmacist, doctor, or health care professional gives you a free consultation on your list of medications, during which they discuss a few things—such as possible side effects, potential interactions between the drugs you take, and even methods for lowering costs. This program can be very helpful for beneficiaries taking many prescriptions. The doctor may also offer suggestions on which drugs you may safely stop taking. To see if you're eligible for the MTM program, contact your Medicare prescription drug plan.

Do Medicare Advantage plans cover the donut hole?

Medicare Advantage plans often come with Part D prescription drug coverage. While all plans must cover at least the minimum coinsurance set by the federal government during the donut hole, they are free to extend additional coverage. So yes, some Medicare Advantage plans do offer extended “gap” coverage for enrollees in the donut hole.

If you’re interested in finding a plan with extended coverage during the donut hole, call an agent and they can help.

Related content

Sources:

- Kaiser Family Foundation, “An Overview of the Medicare Part D Prescription Drug Benefit”

- Kaiser Family Foundation, “An Overview of the Medicare Part D Prescription Drug Benefit”

- Medicare, “Yearly Deductible for Drug Plans”

- Medicare, "Costs in the Coverage Gap"

- Medicare, "Catastrophic Coverage"

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.