How to Switch Medicare Advantage Plans

An object at rest tends to stay at rest. Likewise, a Medicare Advantage enrollee tends to remain in the same plan year after year.

Although beneficiaries can freely change Medicare Advantage plans each year, only about 10% of enrollees take advantage of this annual right.1 One explanation could be that most people are satisfied with their plan—despite annual changes. Another reason might be that the process of finding a plan was such a hassle the first time around, most people would rather not do it again.

We get that. But it doesn’t have to be such a pain. We’ll explain the advantages of switching your Medicare Advantage plan, when you can do it, and how to compare plans to get the best coverage.

Why should I switch my Medicare Advantage plan?

Many people switch Medicare Advantage plans when their current plan becomes too costly—and that’s certainly a good reason to switch. But it’s not the only reason:

You might find better (or more) benefits on another plan. Lately, plans are offering more supplemental benefits like meals, over the counter medication allowances, and telemedicine.

You might get better coverage on another plan. You could find a plan with better coverage for the essentials, like hospital copays. Or you could switch to a plan that your doctor is contracted with. Or, your current plan could stop covering a drug you depend on. Or another plan could offer the same coverage you have now, but for cheaper premiums or copays.

You might need to switch if you move. Some switches are necessary because your current plan’s service area doesn’t operate where you moved to.

Regardless of any reasons for switching, you should read your current plan’s Annual Notice of Change (ANOC) when it arrives each year. The packet outlines how your coverage, premiums, and copays will change the following year.

When can I switch my Medicare Advantage plan?

You can’t switch Medicare Advantage plans whenever you’d like; you must be in an enrollment period first.

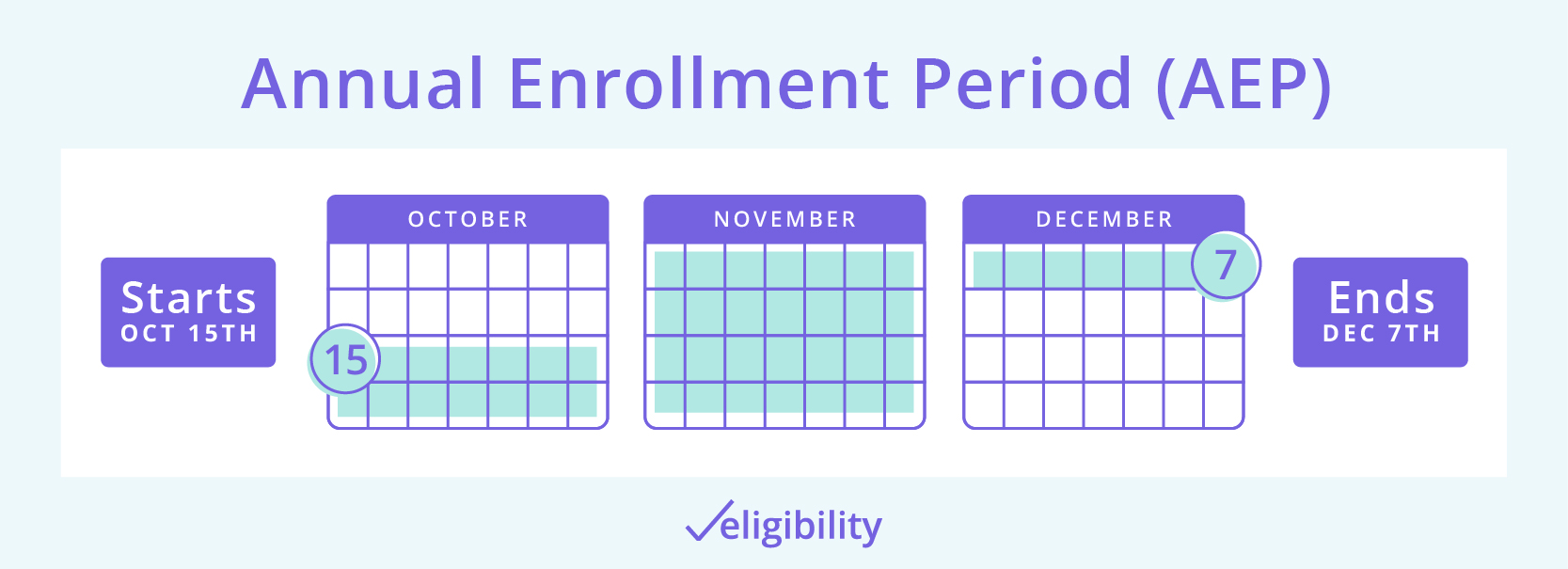

Annual Enrollment Period

The best time to evaluate and switch Medicare Advantage plans is in the fall—during Medicare’s Annual Enrollment Period (AEP). This period begins October 15 and lasts until December 7. During AEP, you can switch to another Medicare Advantage plan, return to Original Medicare, or otherwise modify your coverage however you’d like.

If you switch during this enrollment period, your new plan will take effect on January 1.

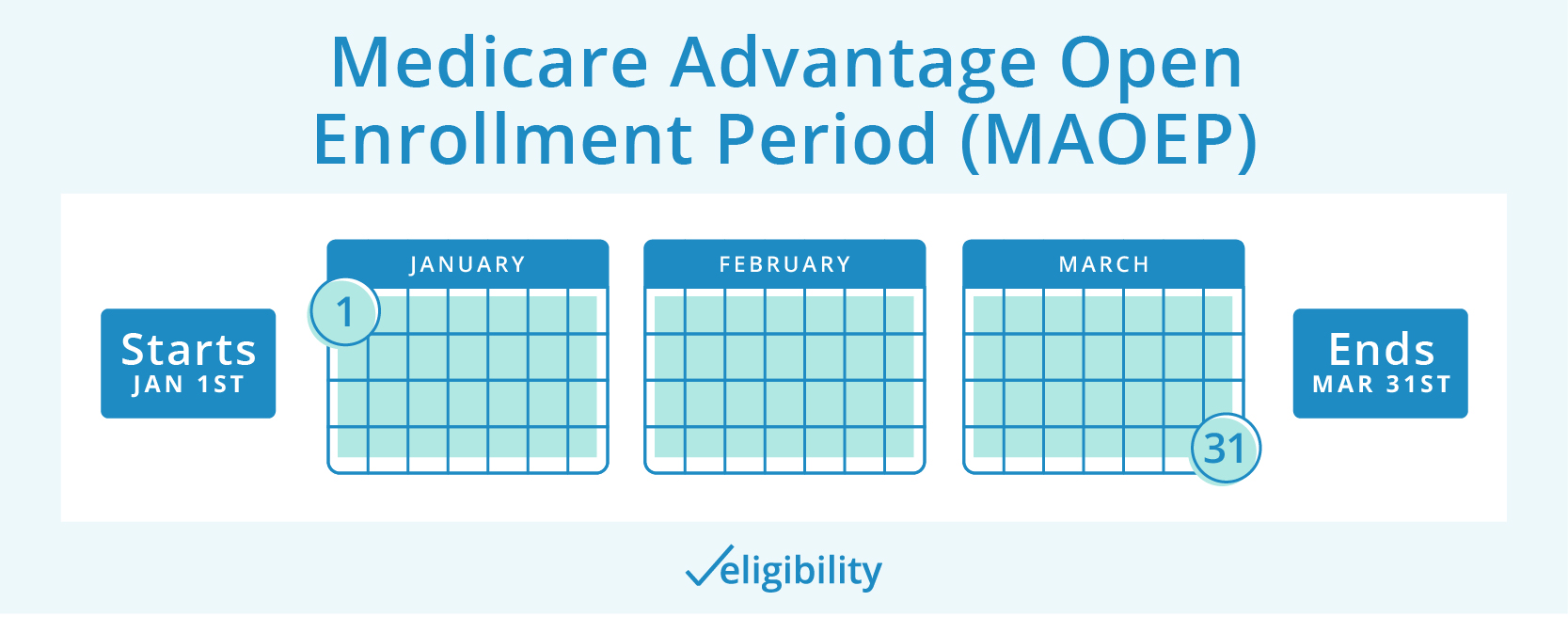

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period (MAOEP) begins January 1 and ends on March 31. You can switch Medicare Advantage plans during this enrollment period or switch back to Original Medicare.

If you use the MAOEP to enroll in a new Medicare Advantage plan, your coverage will usually begin the first day of the following month.

Special Enrollment Period

You’ll typically get a Special Enrollment Period (SEP) if you move out of your current plan’s service area. In most cases, you’ll get around 60 days to switch plans. See Medicare’s full list of special circumstances for an SEP.

Another SEP exists, however: the 5-Star Special Enrollment Period. Medicare rates Medicare Advantage plans on a scale of 1 to 5 stars (5 is best). If a 5-star Medicare Advantage plan is available in your area, you can switch to it during an 11-month period from December 8 to November 30 of the following year.

How do I switch Medicare Advantage plans?

Switching Medicare Advantage plans is pretty easy. And if you switch within an enrollment period, there will be no gaps in your coverage.

As long as you’re in an enrollment period, you can switch with Medicare’s plan finder. If you need help understanding how to compare Medicare Advantage plans and navigating the plan finder, see How to Apply for a Medicare Advantage plan—it’ll walk you through the whole process.

If you’d rather not do all the comparison work yourself, you can call a licensed agent.

Source:

1. Kaiser Family Foundation, “No Itch to Switch: Few Medicare Beneficiaries Switch Plans During the Open Enrollment Period”

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.