How to Switch from Original Medicare to Medicare Advantage

Sometimes, switching from Original Medicare to a Medicare Advantage plan can feel like a tremendous shift. And, in some ways, it is: If you switch, you might be limited to a network. You might need authorization for certain treatments. Your company might change your coverage each year.

But Medicare Advantage comes with, well, advantages. The right Medicare Advantage plan could end up saving you money. And Medicare Advantage plans often include benefits that Original Medicare doesn’t cover.

If you’re on the fence about switching to Medicare Advantage, that’s okay. We’ll cover all the details of switching and point out some things to consider before you make the change.

Why switch to Medicare Advantage?

Medicare Advantage provides all the benefits offered by Medicare Part A and Part B, and most Medicare Advantage plans also include prescription drug (Part D) coverage. If you’re relatively healthy or you don’t frequently use healthcare, switching to Medicare Advantage could end up saving you money.

Beyond potential savings, many people switch to Medicare Advantage for supplemental benefits.

Supplemental benefits are items and services that Original Medicare doesn’t provide. They can include the typical vision, dental, and hearing benefits, or even a membership to SilverSneakers or Silver&Fit. Recently, however, plans are going beyond typical supplemental benefits and including extras such as an allowance for over-the-counter medications, transportation services, and meal delivery. Many plans offer these benefits as a free perk, while other plans require an additional premium for extras such as dental and vision.

Here is a list of supplemental benefits available through Medicare Advantage and the percentage of Medicare Advantage enrollees who have that benefit as part of their plan:

Data from Kaiser Family Foundation. Updated 5/18/201

What should I consider before switching to Medicare Advantage?

Although the perks can be fantastic, Medicare Advantage does have some downsides. Here are some facts you should know before switching from Original Medicare to Medicare Advantage:

- You can’t switch to/from Medicare Advantage whenever you want.

To switch in or out of Medicare Advantage, you must be in an enrollment period. Some enrollment periods occur every year, while others are triggered by special circumstances like moving outside of your plan’s service area—more on that below. - Medicare Advantage usually restricts your coverage to a local/regional network.

If you travel a lot or you’re a snowbird/sunbird, keep in mind that Medicare Advantage typically limits your coverage to a local network—unless you can find a Medicare Cost Plan, a type of Medicare Advantage plan that works nationwide. Additionally, your Medicare Advantage care will most likely be overseen by your primary care physician (PCP), meaning you may need to get approval from your PCP before getting treatment from a specialist or other expensive procedures. - You must drop your Medigap plan (if you have one).

If you have a Medigap (Medicare Supplement) plan, you’ll need to drop it before your Medicare Advantage coverage starts. You cannot have both Medigap and Medicare Advantage at the same time.

Essential details about Medigap: If you purchased a Medigap plan when you enrolled in Medicare Part B, you might have a trial right for Medicare Advantage. A trial right means that you can switch to Medicare Advantage and, if you decide you don’t want to stay in Medicare Advantage, you have up to 365 days to switch back to Original Medicare and get your old Medigap plan back.

If you don’t have a trial right or guaranteed issue rights, you may have a more difficult time buying a Medigap plan if you switch back to Original Medicare.

When can I switch to Medicare Advantage?

To switch from Original Medicare to Medicare Advantage, you must be in one of the following enrollment periods:

Initial Enrollment Period (IEP)

Your Initial Enrollment Period starts three months before your 65th birthday month and ends three months after your 65th birthday month—seven months total. During your IEP, you can switch to Medicare Advantage (but you’ll need to enroll in Original Medicare first).

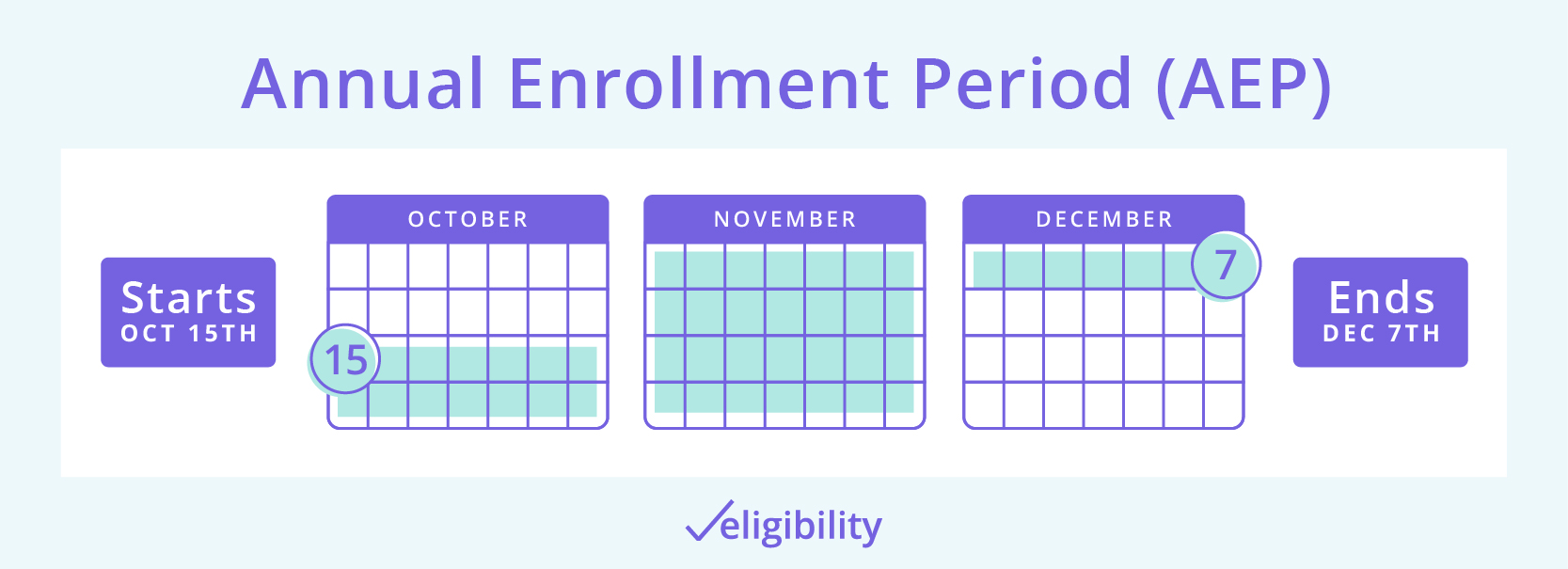

Annual Enrollment Period (AEP)

The Annual Enrollment Period starts October 15 and lasts until December 7. During AEP, you can change your coverage in several ways, and that includes switching to Medicare Advantage.

Special Enrollment Period (SEP)

You may qualify for a Special Enrollment Period in specific circumstances, such as when you lose employer coverage. In most cases, Special Enrollment Periods last two months.

See Medicare.gov’s full list of SEPs and timelines.

How do I switch to Medicare Advantage?

Once you’re ready to switch to Medicare Advantage and you’re in an enrollment period, you can either use Medicare’s Plan Finder tool or call a licensed agent for help.

If you want to do it yourself, follow our step-by-step guide for enrolling in a Medicare Advantage plan to ensure you get the best plan possible.

And, if you’re still on the fence about Medicare Advantage, you may find more answers in Medicare Advantage vs. Medigap: Which is Better?

Source:

1. KFF.org, “A Dozen Facts About Medicare Advantage in 2020”

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.