How Medicare and Social Security Work Together

Both Social Security and Medicare help older Americans and those with disabilities. Social Security provides monthly income checks, while Medicare provides health insurance. Although they are two separate programs with different benefits, they have similar funding methods, eligibility requirements, and enrollment steps.

Together, they can provide you with the benefits you need while you’re not working.

Social Security benefits

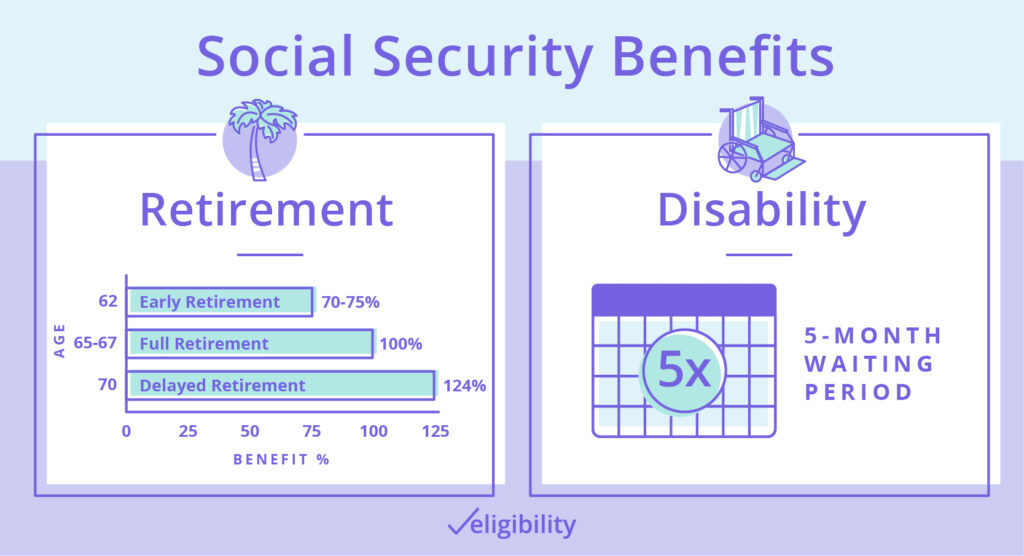

Social Security benefits come in the form of a check during retirement, or earlier if you have a disability. How much you receive during retirement is based on your income during your 35 highest-earning years. The amount also depends on your age when you begin receiving your Social Security checks.

Full Social Security retirement age is between 65 and 67, depending on when you were born.1

You can receive benefits as early as 62, but the amount could be 25% to 30% lower. Or, you can delay benefits until age 70 and earn up to an additional 8% per year.2 You aren't required to begin receiving checks at 70, but you won't rack up any extra benefits after that.

If you qualify for benefits due to disability, you’ll have to wait five months after diagnosis to begin receiving money.

Medicare benefits

Medicare benefits come in several parts, most of which aren't free.

- Part A covers you during a stay in a hospital or skilled nursing facility. It also includes hospice and some home health care.

- Part B covers routine medical services such as doctor visits, lab testing, preventative care, and durable medical equipment (DME).

- Part C (Medicare Advantage) is an alternative way of receiving both Parts A and B all in one plan. Many plans also cover prescription drugs.

- Part D is prescription drug coverage that you can add if you have Part A and Part B.

- Medicare Supplement (Medigap) is an optional add-on that pays for the “gaps” in Parts A and B, such as deductibles, coinsurance, and excess charges.

Recipients customize their coverage by choosing either Original Medicare (Parts A and B) or Medicare Advantage. Those who want Original Medicare can add Part D, Medigap, or both.

What if you have other kinds of benefits too?

Social Security and Medicare aren’t the only ways to have income and health insurance. Many people buy policies and other financial products that offer similar benefits.

Disability income insurance

Like Social Security disability benefits, this insurance pays out if you become disabled and can’t work. Your Social Security benefits won’t be affected by any additional disability coverage you have. But look your policy over carefully. Some pay out less if you receive Social Security disability checks at the same time.

Retirement funds

To supplement Social Security retirement income, many people build retirement funds over a lifetime. These accounts don’t typically affect the size of your Social Security checks.

The most common account types include the following:

401(k), 403(b), or 457(b): These are investment accounts established (and sometimes partially funded) by employers. Private companies usually have 401(k)s, nonprofits have a 403(b)s, and government agencies have 457(b)s. There are also Solo 401(k) options for the self-employed.

Individual Retirement Account (IRA): These are accounts you can open on your own to fund your retirement. Traditional IRAs defer taxes until you begin withdrawing funds, while Roth IRAs are funded with post-tax income.

Annuities: These financial products provide a steady income during retirement. You can fund them slowly over many years or all at once with a lump sum.

Health Savings Account (HSA): These accounts accompany high-deductible health plans and are funded with pre-tax dollars. They remain tax-free if you use the funds only to pay for medical expenses. While these accounts don’t affect your Social Security benefits, they can have implications for Medicare benefits.

Health insurance

If you have additional health coverage while on Medicare, one of your plans will be the primary coverage—that is, it has the first responsibility for paying your medical bills. The other becomes secondary coverage. Whether Medicare is the primary or secondary payer depends on the type of coverage you pair it with.

Here are the most common options:

Health insurance at work: If you’re still working when you become eligible for Medicare, you may be able to defer enrolling in Parts A and B. If your employer has more than 20 employees, the employer-sponsored plan pays first, and you can simply wait to enroll in Medicare until you retire. However, if your employer is smaller, you may have to enroll in Medicare as soon as you’re eligible because your work coverage might pay only after Medicare covers its share.

Health Marketplace: If you don’t have employer-sponsored health insurance, you can buy an individual plan from the Marketplace at HealthCare.gov. Usually, once you have Medicare, you can’t buy a Marketplace plan; but if you already have one, you can keep it. Most people don’t do this, however, because once you enroll in Medicare you’re no longer eligible for the tax credit to help pay your Marketplace plan premiums. You'll pay the full price.

Short term health insurance: If you lose health insurance for any reason and won’t receive Medicare benefits for a few months, you could purchase short term health insurance. However this coverage won’t be credible, so it’s not a good option for delaying enrollment in Medicare after you’re eligible.

TRICARE: Available to US military, this coverage can complement your Medicare coverage. If you have part A, you must also enroll in Part B to keep TRICARE. Medicare serves as the primary payer.

Cost and funding

While Social Security and Medicare deliver different benefits, their funding comes (in part) from the same place: your paycheck.

Along with income taxes, you’ll see the following amounts on your pay stub as a percentage of your income:

- Social Security: 6.2%

- Medicare: 1.45% for most, 2.35% for incomes of $200,000 or more

Your employer will also contribute to Medicare, but that won’t affect your paycheck.3

Once you begin taking Social Security benefits, there is no additional cost unless you're still working. However, there are other Medicare costs when you enroll. These include premiums, deductibles, coinsurance, and copays.

Eligibility

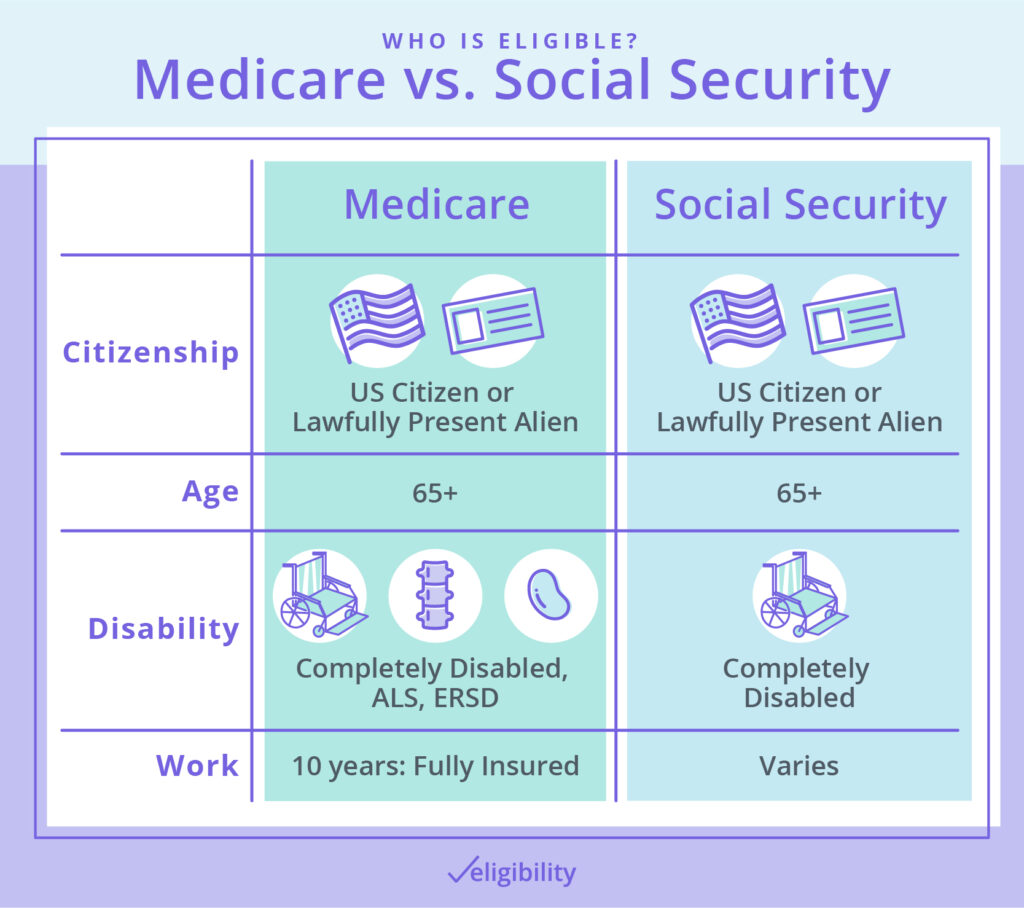

To receive benefits from either program, you must meet specific requirements for eligibility. These include citizenship status, age, disability status, and work history. The Social Security Administration determines eligibility for both programs.

Citizenship status

For both Social Security and Medicare, you must be a US citizen or a lawfully present alien to receive benefits. Or you could qualify if your spouse meets these requirements.

Age

You can qualify for either program based on age, but the specifics are different for each.

Medicare: You must be 65 or older.

Social Security: Qualification age is a moving target. You can begin taking partial benefits at age 62, but your checks could be 25% or 30% lower.1 The full qualification age is between 65 and 67, depending on when you were born.

Full Social Security retirement benefits

Table based on SSA.gov. Data as of 6/24/2020.

If you don't claim benefits until age 70, your checks could be up to 8% higher for every year you wait.2 You can wait longer, but you won’t rack up more benefits after 70.

Disability

If you don’t meet the age requirements for Social Security and Medicare, you might still qualify due to a disability.

Social Security

Qualifying for disability is tough. It’s usually much easier to qualify for private disability insurance because the definition of “disability” is less stringent.

Here’s how the Social Security Administration defines disability:

Medicare

You might be eligible for Medicare benefits based on disability if you meet one of the following requirements:

- You have received Social Security disability benefits for two or more years.

- You have Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s Disease.

- You have end-stage renal disease (ESRD).

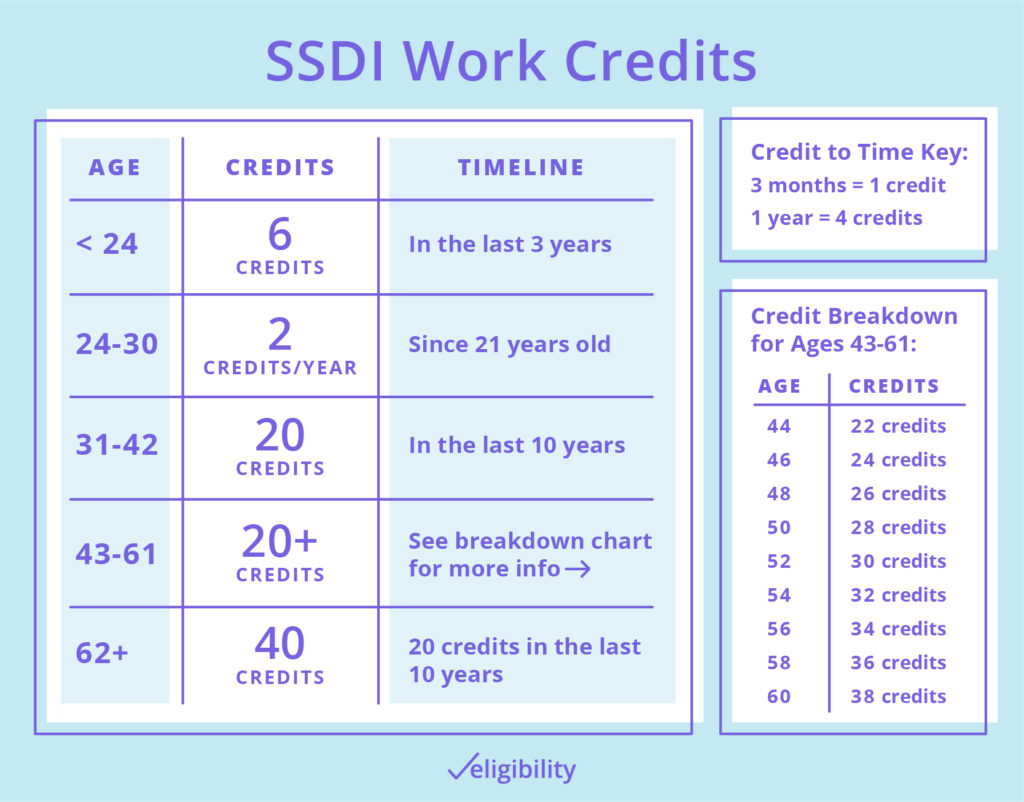

Work credits

Eligibility for both programs is based, at least in part, on your work record. You earn one work credit for every quarter (three-month period) you make $1,410 or more.4 That's up to four credits per year. How many you need depends on which benefit you want to collect. For both programs, you may be able to qualify based on the record of your current, ex-, or deceased spouse.

Social Security

For retirement benefits you must earn six credits (1.5 years) during your lifetime, regardless of age. But for disability, you must have earned credits recently—how recently and how many credits depends on your age.

Graphic created using information at https://www.ssa.gov/ssi/text-entitle-ussi.htm. Data as of 7/23/2020.

Medicare

Technically, you don’t have to work a day in your life to qualify for Medicare benefits, but you may pay more for Part A.

Table created using data from Medicare.gov. Data as of 6/24/2020.

Enrollment

To receive Social Security or Medicare benefits, you’ll need to enroll around the time you wish to receive them. For both benefits, you’ll apply through the Social Security Administration in one of three ways:

- Online at SSA.gov

- By phone at 1-800-772-1213 (TTY 1-800-325-0778)

- In-person at your nearest SSA office

Due to COVID-19, SSA offices near you may be closed or have limited hours and appointments. Call your local office to make sure they’re open, and always practice social distancing.

When you apply for benefits depends on which program you're interested in.

Enrolling in Social Security

You can begin applying for retirement benefits four months before you'd like to receive your first check—provided you're at least 61 years and nine months old.

For disability, you can apply at the time your condition is diagnosed, but you won’t receive benefits until after a five-month waiting period.

Enrolling in Medicare

Unless you plan to continue working, it’s best to apply for Medicare when you first become eligible at age 65. You’ll have your own seven-month initial enrollment period (IEP) beginning three months before the month you turn 65 and ending three months after.

If you qualify for Medicare by disability, your IEP will begin three months before your 25th month on disability and continue three months after.

During IEP, you’ll apply for Parts A and B. You can also add Part D or Medigap, or switch to Medicare Advantage. Because Part D, Medigap, and Medicare Advantage plans are provided by insurance companies, you'll apply with the insurer—not the Social Security Administration.

Learn more about applying for each part of Medicare:

Or you can simply speak with a licensed Medicare agent who can help you find the right plan for your situation—and start the enrollment process.

If you plan to delay retirement, you can still enroll in Medicare at age 65. If you decide to delay signing up and have coverage that's as good or better than Medicare (this is known as creditable coverage), you can sign up when your coverage ends. At this time, you can ask for a special enrollment period (SEP).

Learn more about Medicare enrollment periods.

Your Social Security and Medicare benefits

Social Security and Medicare provide different kinds of benefits to people 65 or older and those with disabilities. Social Security provides a steady income, while Medicare is health insurance. But both programs have similar funding, eligibility requirements, and enrollment steps.

Chances are if you have Medicare, you also have Social Security benefits—or you will soon. Knowing how these programs interact can help you maximize your benefits. To learn more about Medicare, check out our Medicare Guide. Or learn more about Social Security. In this case, knowledge isn’t just power. It’s also money.

Sources

- Social Security Administration, “Starting Your Retirement Benefits Early”

- Social Security Administration, “Delayed Retirement Credits”

- Internal Revenue Service, “Topic No. 751 Social Security and Medicare Withholding Rates”

- Social Security Administration, “Social Security Credits”

Content on this site has not been reviewed or endorsed by the Centers for Medicare & Medicaid Services, the United States Government, any state Medicare agency, or any private insurance agency (collectively "Medicare System Providers"). Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.